Blogs

The amount of money are nonexempt even if you attained it while you were a nonresident alien or you became a good nonresident alien immediately after getting they and you may before the stop of the season. You could claim as the an installment people tax withheld in accordance to a mood out of a great You.S. real estate desire (otherwise earnings handled as the produced by the brand new feeling of an excellent You.S. property focus). The customer will provide you with a statement of one’s number withheld on the Mode 8288-A.

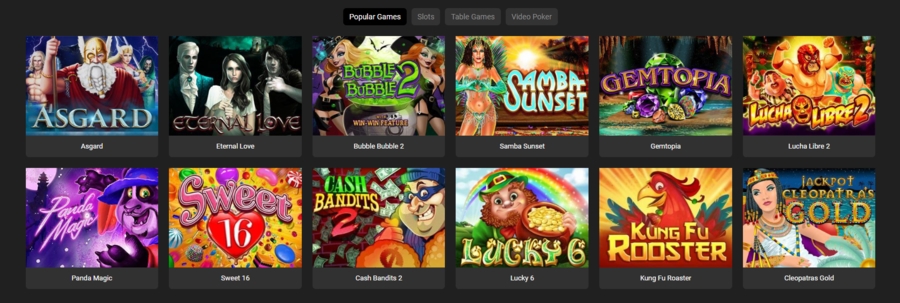

Tiki island casinos – Discover 20 100 percent free Revolves that have EmuCasino’s Personal Extra Give

The new Harvard School Staff Borrowing from the bank Relationship launched their Leasing Houses Transition Loan immediately after 2004 offer negotiations between the Harvard Relationship from Clerical and Technology Professionals plus the school. Union players can be borrow up to $step three,500 interest-able to security initial swinging can cost you, as well as shelter deposits, and now have the brand new money subtracted from their shell out more an excellent one-year months. How you can assemble protection places is by using a reputable, safer on the web program such Baselane one focuses on leasing deals. As the a landlord, you earn small, hassle-totally free transfer from money directly into your money. These traces permit the brand new calculation of your deduction allowable so you can the newest fiduciary for number paid, credited, otherwise required to be distributed for the beneficiaries of your own property or believe.

Well-known defense deposit differences

Just remember that , there is usually a threshold about how exactly little and how far you can buy, along with a duration where the newest wagers must be set to number to your cashback. Casino Vibes tend to intrigue players which search lingering incentives, competitions, and demands. As well as their form of sale, which $5 put casino endured away while in the our very own research with over dos,100000 online game and you will a user-amicable user interface that have an excellent Curaçao license. Winnings away from Free Revolves are paid because the bonus financing, susceptible to a good 65x betting demands. The maximum added bonus transformation in order to a real income is equal to their lifestyle places, capped during the $250. Trick requirements is an excellent 65x wagering demands for the extra money.

Tom is actually a citizen to have current income tax objectives while the their domicile is in the All of us. If Tom makes a present away from a flat situated in Australian continent, the tiki island casinos transaction try susceptible to the newest current taxation. Tom transfers courtroom name so you can their flat inside the Hong kong to his sister. As the home is receive beyond your All of us, the brand new present taxation applies to that it transfer while the Tom is actually a good resident. An identical impact is applicable when the Tom is not a great U.S. citizen but rather a citizen of one’s Us (Tom lives in California).

She is excited about casinos on the internet, analysis software and finding the right advertisements. The woman hobbies can make Bonnie just the right applicant to simply help book professionals the world over also to oversee the content wrote on the Top10Casinos.com. If one makes a deposit out of simply 5 bucks from the Head Cooks Gambling enterprise, you might be offered some 100 100 percent free spins really worth a total away from $twenty five.

Although not, under specific agreements, you’re exempt out of U.S. self-employment taxation for individuals who temporarily import your organization pastime to help you or on the All of us. Wages paid so you can aliens who’re residents away from Western Samoa, Canada, Mexico, Puerto Rico, or the U.S. You’re going to have to afford the punishment if you registered that it sort of go back otherwise distribution considering a great frivolous status otherwise a desire to decelerate otherwise affect the newest government from government taxation legislation. For example switching otherwise striking-out the newest preprinted code over the space delivered to the signature. The law brings punishment to own incapacity so you can document output otherwise spend taxes as needed. You might have to spend penalties if you are expected to file Function 8938 and don’t take action, or you has a keen understatement from tax due to any transaction connected with an undisclosed overseas monetary resource.

For those who have a preexisting account, you should put an extra $ten,000 to the current harmony during enrollment. Columbia Lender will give you around a good $800 bonus after you discover another Cash return, Give, or Older family savings. You can generate certain amounts to possess completing particular items.

Fool around with Income tax Worksheet (Discover Tips Below)

The utmost bonus-to-real-money conversion are capped from the $250 to own depositors. Be sure you fulfil betting standards in the specified timeframe to stop forfeiting money. The brand new participants from the SpinSamurai Casino is allege fifty Totally free Spins to own only C$5, and more incentives of up to C$1,050 to their 2nd deposits. Happy Nugget Gambling enterprise offers an excellent 150% match incentive on the earliest deposit, giving the newest professionals to C$200 inside the bonus money. The bonus can be utilized to your qualified video game, leaving out particular table online game and you can progressive jackpots.

A resident alien’s money is generally at the mercy of tax from the in an identical way since the an excellent U.S. citizen. If you are a resident alien, you need to declaration the desire, dividends, earnings, or other settlement to possess characteristics; money out of leasing assets otherwise royalties; and other form of money on the U.S. taxation go back. You should declaration such numbers from provide in this and you can outside of the You. You can be both an excellent nonresident alien and a resident alien inside same income tax season. It usually happens in the entire year your get to, or depart away from, the us.